Some Known Factual Statements About Paul B Insurance Medicare Supplement Agent Huntington

Wiki Article

Paul B Insurance Medicare Supplement Agent Huntington for Dummies

Table of ContentsNot known Details About Paul B Insurance Medicare Advantage Plans Huntington The smart Trick of Paul B Insurance Medicare Agency Huntington That Nobody is Talking AboutThe Definitive Guide to Paul B Insurance Medicare Health Advantage HuntingtonLittle Known Questions About Paul B Insurance Medicare Supplement Agent Huntington.Paul B Insurance Medicare Agent Huntington - Questions

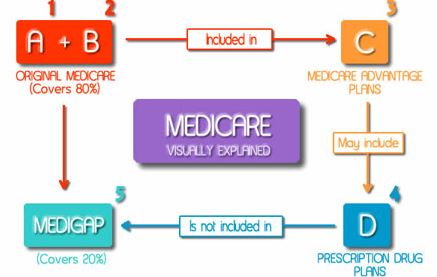

When you utilize the Medicare Select network hospitals and providers, Medicare pays its share of approved charges and also the insurer is in charge of all additional advantages in the Medicare Select plan. Generally, Medicare Select plans are not needed to pay any advantages if you do not utilize a network company for non-emergency solutions.Currently no insurers are providing Medicare Select insurance coverage in New york city State. Medicare Advantage Strategies are accepted and also managed by the federal government's Centers for Medicare and also Medicaid Services (CMS). For info regarding which Strategies are readily available as well as the Plan's advantages as well as costs rates, please call CMS straight or see CMS Medicare web site.

What are the advantages and limitations of Medicare Advantage strategies? Medicare Benefit broadens health and wellness care alternatives for Medicare beneficiaries. These choices were created with the Well balanced Spending Plan Act of 1997 to reduce the growth in Medicare spending, make the Medicare trust fund last longer, and also offer recipients extra choices.

More About Paul B Insurance Medicare Advantage Agent Huntington

You ought to not transform to a new program until you have carefully assessed it and identified how you would gain from it. Initial Medicare will constantly be offered. If you want to continue getting your advantages by doing this, after that you do not have to do anything. This is a handled treatment plan with a network of providers who get with an insurance provider.

This is comparable to the Medicare Advantage HMO, other than you can utilize companies outside of the network. This is another managed care strategy.

This is an insurance policy strategy, not a taken care of care plan. The plan, my review here not Medicare, sets the fee routine for suppliers, yet service providers can bill up to 15% even more.

All about Paul B Insurance Medicare Insurance Program Huntington

This is just one of the taken care of care strategy kinds (HMO, HMO w/pos, PPO, PSO) which is formed by a religious or fraternal organization. These strategies may restrict registration to members of their company. This is a medical insurance plan with a high deductible ($3,000) integrated with a savings account ($2,000).

The strategy has to have a grievance and charm procedure. If a layman would certainly believe that a symptom could be an emergency, after that the strategy should pay for the emergency situation treatment.

All plans have a contract with the Centers for Medicare and also Medicaid Provider (Medicare). The plan has to enroll anybody in the service location that has Component An as well as Part B, except for end-stage renal illness individuals.

The Paul B Insurance Medicare Agent Huntington Ideas

You pay any type of strategy costs, deductibles, or copayments. All strategies might offer extra advantages or services not covered by Medicare. There is usually less paperwork for you. The Centers for Medicare and also Medicaid Provider (Medicare) pays the plan a set amount for every month that a recipient is registered. The Centers for Medicare and also Medicaid special info Providers keeps an eye on charms and marketing plans.

If you meet the following requirements, the Medicare Advantage plan must enroll you. You might be under 65 as well as you can not be rejected insurance coverage due to pre-existing problems. You have Medicare Component An and Part B.You pay the Medicare Part B premium. You reside in an area serviced by the plan.

You are not receiving Medicare due to end-stage kidney disease. You have Medicare Part An and also Part B, or just Part B.You pay the Medicare Part B premium.

Medicare Advantage strategies must supply all Medicare covered services as well as are authorized by Medicare. Medicare Benefit plans might provide some services that Medicare doesn't typically cover, such as regular physicals and also foot care, oral treatment, eye tests, prescriptions, listening to aids, as well as other preventative solutions. Medicare HMOs may provide some solutions that Medicare doesn't generally cover, such as routine physicals and foot care, dental treatment, eye tests, prescriptions, hearing help, and also various other precautionary solutions.

Not known Facts About Paul B Insurance Medicare Agent Huntington

You do not require a Medicare supplement plan. You have no bills or claim types to finish. Declaring as well as organizing of claims is done by the Medicare Advantage plan. You have 24-hour accessibility to solutions, including emergency situation or urgent treatment with suppliers beyond the network. This consists of international travel not covered by Medicare.Report this wiki page